Analysis of the operational characteristics and situation of the aluminum industry

Yinsheung Aluminum Published on 2023-08-26

Monthly Prosperity Index Report on China's Aluminum Smelting Industry -July 2023

By China Nonferrous Metals Industry Association

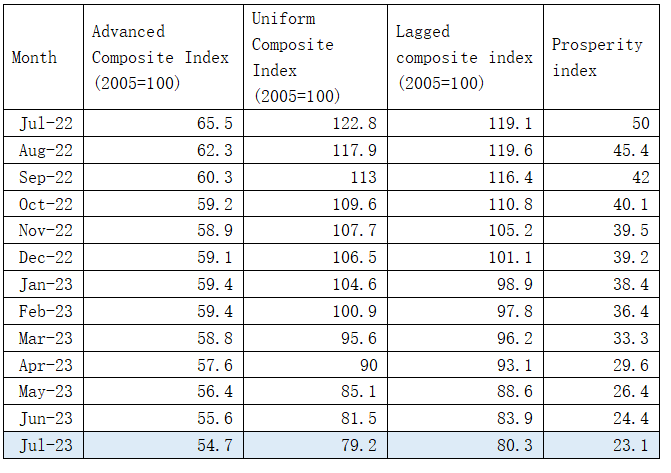

In July 2023, the prosperity index of China's aluminum smelting industry was 23.1, a decrease of 1.3 points compared to the previous month, and it was in the middle of the "slightly cold" range; The preliminary composite index was 54.7, a decrease of 0.9 points compared to the previous month. The prosperity index of China's aluminum smelting industry in the past 13 months is shown in Table 1.

Table 1 Prosperity Index of China's Aluminum Smelting Industry in the Last 13 Months

The prosperity index is within a relatively cold range

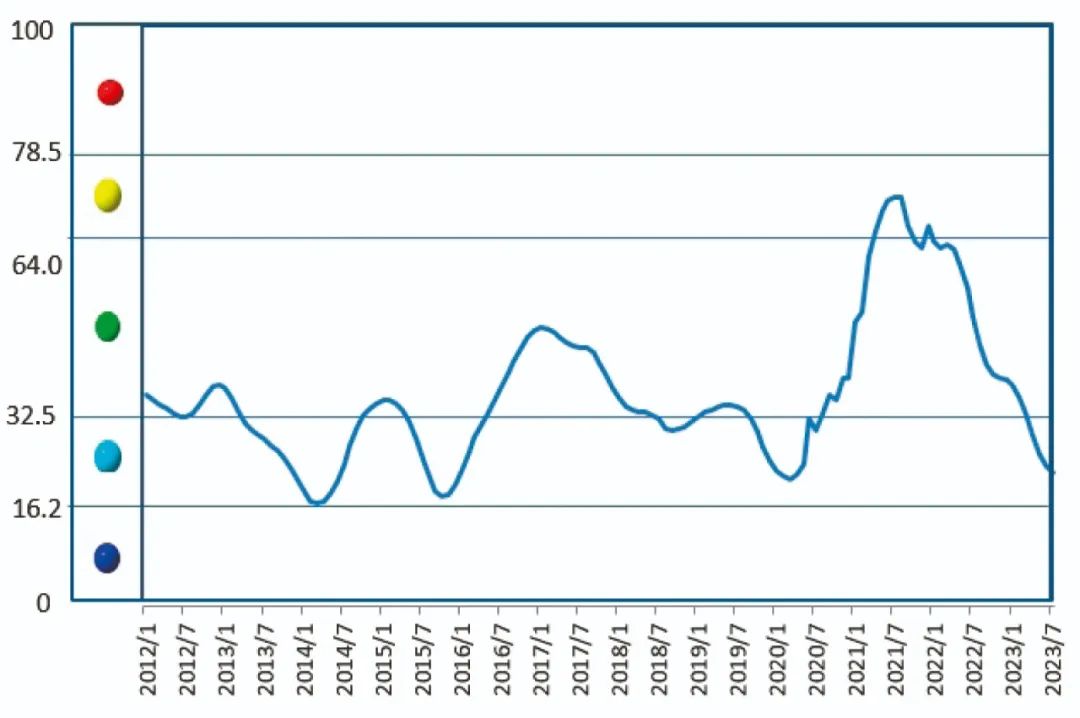

And compared to the previous month, it decreased. In July 2023, the prosperity index of China's aluminum smelting industry was 23.1, a decrease of 1.3 points compared to the previous month, and it was in the middle of the "slightly cold" range. The monthly prosperity index trend of China's aluminum smelting industry is shown in Figure 1.

Figure 1 Trend Chart of China's Aluminum Smelting Industry Prosperity Index

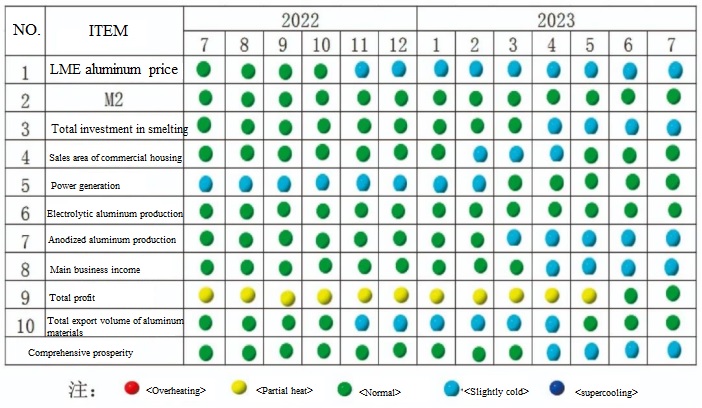

Figure 2 Signal Light for the Prosperity of China's Aluminum Smelting Industry

From the prosperity signal light of China's aluminum smelting industry (see Figure 2), it can be seen that in July 2023, among the 10 indicators that constitute the industry prosperity index, six indicators, including M2, power generation, electrolytic aluminum production, sales area of commercial housing, total aluminum exports, and total profit, were all in the "normal" range; The four indicators of LME aluminum settlement price, total investment in aluminum smelting, alumina production, and main business income are in the "cold" range.

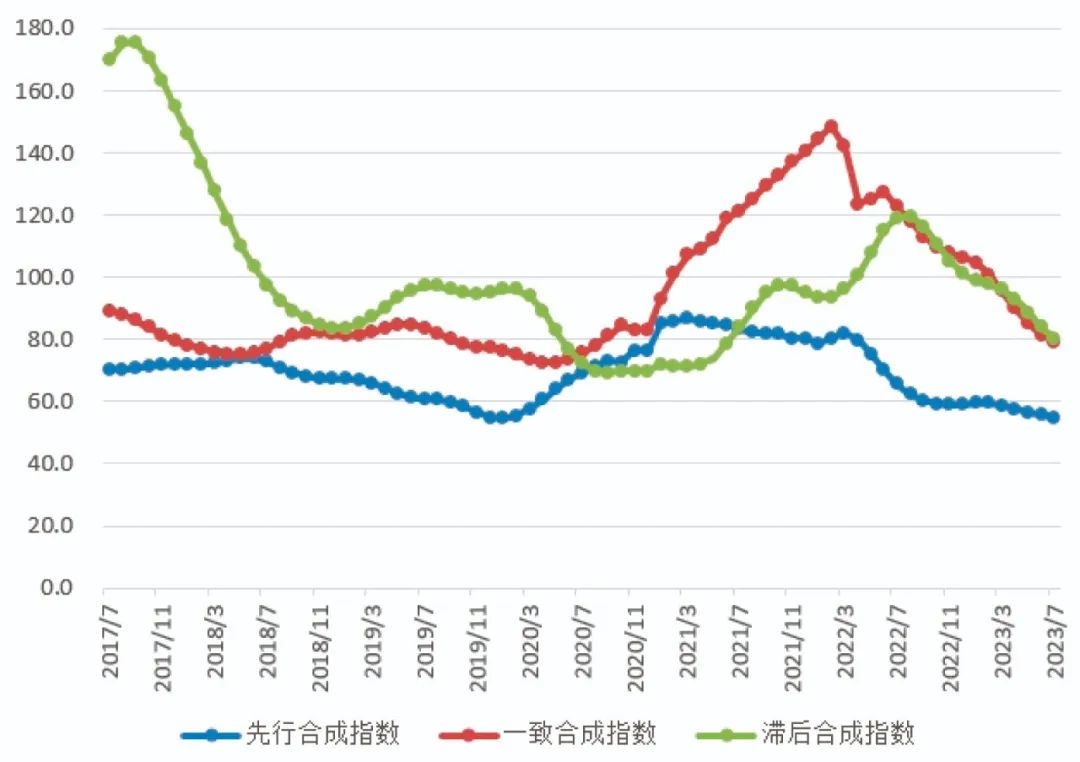

The leading composite index decreased in July 2023 to 54.7, a decrease of 0.9 points compared to the previous month. The composite index curve of China's aluminum smelting industry is shown in Figure 3. Among the five indicators that constitute the leading composite index, after seasonal adjustment, four indicators have decreased compared to the previous month. Among them, the LME aluminum settlement price has decreased by 1.4%, the total investment in aluminum smelting has decreased by 4.0%, the sales area of commercial housing has decreased by 9.9%, and the power generation has decreased by 0.2%.

Figure 3 Composite Index Curve of China's Aluminum Smelting Industry

Industry operation characteristics and situation analysis In July, the overall prosperity of the aluminum smelting industry was in the middle of the "slightly cold" range, with specific operational characteristics as follows:

One is that multiple factors have led to an upward trend in aluminum prices. In July, the overall price of aluminum showed an upward trend. On the overseas side, there is uncertainty in monetary policy, but there is high directional certainty, and the downward trend of the US dollar index continues. On the domestic front, the Central Political Bureau meeting held that month pointed out that China's economy has enormous development resilience and potential, and the long-term positive fundamentals have not changed. It also proposed to actively expand domestic demand, optimize real estate policies, and actively follow up in multiple regions. In addition, major banks have started to reduce interest rates, which has significantly strengthened market optimism. In July, the main contract price of Shanghai Aluminum was between 17802 to 18594 yuan/ton, with an average price of 18198 yuan/ton, a month on month increase of 371 yuan/ton, an increase of 2.1%, and a year-on-year increase of 106 yuan/ton, an increase of 0.6%. The price trend of Shanghai Aluminum's main contracts is shown in Figure 4.

Figure 4: Price Trend of Shanghai Aluminum Main Contract

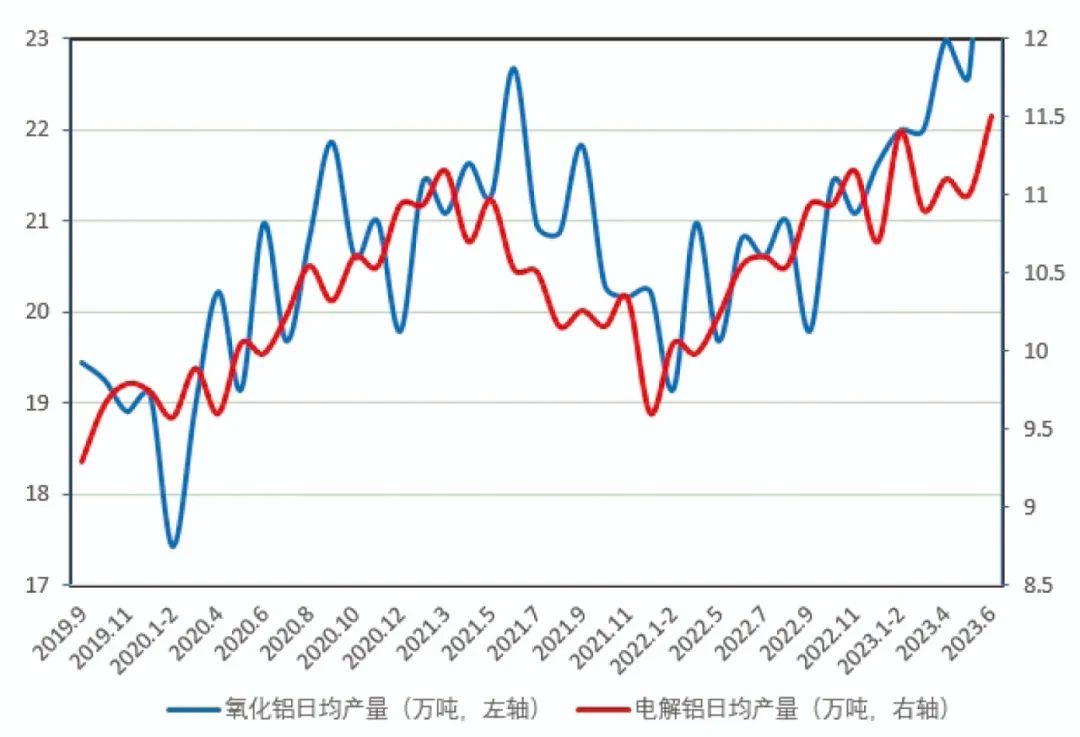

Secondly, the overall production remains stable. In June, the production capacity of electrolytic aluminum and alumina in China increased and decreased simultaneously, and the overall production remained stable. The Yunnan region has entered a period of abundant water and is continuing to resume production, with a relatively optimistic pace. As of the end of June, the province has resumed production of over 1 million tons; A small amount of electrolytic aluminum production capacity in Guizhou has also been released; Affected by high temperature weather in Sichuan, the situation of power shortage has become increasingly severe. Meishan City and Aba Prefecture electrolytic aluminum plants have experienced large-scale shutdown and production reduction, and Guangyuan City has also begun to reduce production under the policy of making electricity more accessible to the people. In June, the national production of electrolytic aluminum reached 3.455 million tons, a year-on-year increase of 2.9%; The daily average production is 115000 tons, a month on month increase of 5000 tons and a year-on-year increase of 2000 tons. In June, the production of alumina was 7.09 million tons, a year-on-year decrease of 2.3%; The daily average production is 236000 tons, a month on month increase of 10000 tons and a year-on-year decrease of 8000 tons. The monthly daily average production of aluminum smelting products is shown in Figure 5.

Figure 5 Monthly Daily Average Production of Aluminum Smelting Products

Thirdly, the apparent consumption of domestic aluminum is lower than expected. Currently in the off-season of aluminum consumption, downstream demand has not performed as expected. In June, in terms of aluminum processing, the operating rate of domestic aluminum downstream processing leading enterprises was 63.8%, a year-on-year decrease of 2.7%; In terms of real estate, the market is showing a downward trend. Currently, the overall real estate market is in the bottoming stage, and the long-term mechanism of the market is also constantly improving; In terms of automobiles, the production and sales of automobiles increased in both month on month and year on year, but the same period last year saw high growth driven by policies such as halving the purchase tax on gasoline vehicles, and the growth rate slowed down in the same period this year.

From the main areas of aluminum consumption, in terms of real estate, the national investment in real estate development in June was 1284.86 billion yuan, a year-on-year decrease of 20.6%; The construction area of real estate development enterprises' houses is 120.418 million square meters, a year-on-year decrease of 30.5%; The newly constructed area of the house is 101.568 million square meters, a year-on-year decrease of 31.4%; The completed area of the house is 60.779 million square meters, a year-on-year increase of 15.2%. In terms of automobiles, in June, the production and sales of automobiles completed 2.561 million and 2.622 million units respectively, with a month on month increase of 9.8% and 10.1%, and a year-on-year increase of 2.5% and 4.8%, respectively. In June, the national aluminum alloy production reached 1.266 million tons, a year-on-year increase of 17.8%; The production of aluminum materials reached 6.031 million tons, a year-on-year increase of 13.0%.

Fourthly, the import of bauxite increased year-on-year, while the export of aluminum materials decreased year-on-year. Due to poor domestic bauxite endowment, aluminum resources maintain net imports. In terms of bauxite imports, China's bauxite imports have maintained a growth trend. In June, China imported 11.563 million tons of aluminum ore sand and concentrate, a decrease of 10.5% month on month and a year-on-year increase of 22.9%. Among them, 8.127 million tons were imported from Guinea, a decrease of 16.7% month on month and a year-on-year increase of 41.5%; Imported 2.979 million tons from Australia, an increase of 13.4% month on month and 22.2% year-on-year. In terms of aluminum materials, we will continue to maintain a development pattern that focuses on domestic circulation and promotes both international and domestic circulation. In June, China's exports of unwrought aluminum and aluminum products reached 438000 tons, a decrease of 1.1% month on month and 0.5% year-on-year.

In summary, on the premise that the national economy continues to maintain a stable and restored development trend, it is expected that in the future, China's aluminum smelting industry will continue to operate in a "slightly cold" range.

Notes:

1. The aluminum smelting industry prosperity leading composite index (referred to as the leading index) is used to determine the recent trends in the economic operation of the aluminum smelting industry. The index consists of the following five indicators: LME aluminum settlement price, M2, total fixed assets investment of aluminum smelting project, sales area of commercial housing, and power generation.

2. The consistent composite index (referred to as the consistent index) of the aluminum smelting industry reflects the current economic operation status of the aluminum smelting industry. The index is composed of five indicators: electrolytic aluminum production, alumina production, operating revenue of aluminum smelting enterprises, total profit of aluminum smelting enterprises, and total export of aluminum materials.

3. The lagging composite index (referred to as lagging index) of the aluminum smelting industry, along with consistent indicators, is mainly used to monitor the trend of economic changes and play a role in post event verification. The index is composed of three indicators: working capital balance of aluminum smelting enterprises, accounts receivable balance of aluminum smelting enterprises, and finished product fund balance of aluminum smelting enterprises.

4. The comprehensive prosperity index reflects the current level of prosperity in the development of the aluminum smelting industry. The prosperity light chart divides the economic operation status of the aluminum smelting industry into five levels, with a "red light" indicating overheating, a "yellow light" indicating overheating, a "green light" indicating normal economic operation, a "light blue light" indicating cooling, and a "blue light" indicating undercooling. Assign different weights to individual indicator lights, and the comprehensive prosperity index compiled from them is also displayed by five light zones.

The comprehensive prosperity index consists of 10 indicators, namely the leading index and the consistent index.

5. All indicators used in compiling the index have been seasonally adjusted and seasonal factors have been removed.

6. The previous monthly prosperity index will be revised every month. When the latest month's data is added to the time series, the previous monthly prosperity index will change to some extent, which is the result of the model's automatic correction.